Usually its easiest if you own a. Risk of maxing out your card.

Can You Consolidate Car Loans And Credit Cards Spendster Budgeting Debt Help Credit Card Reviews

Resolve From 15k to 300k Debt.

. No loan is a cakewalk however. National Debt Relief Receives the Top Ranking in Our Evaluation. Ad View Editors 1 Pick.

Balance transfers personal loans home. Ad Consolidate 20K-100K Credit Card Debt. One Low Monthly Payment.

If you get a consolidation loan and keep. Unlike credit card loans auto loans will usually have a low-interest rate however they are secured loans so there will be collateral ie. Ad Consolidate 20K-100K Credit Card Debt.

To understand if consolidating credit card debt is the. If you need to save some money the Jerry app can help make sure youre getting the best deal on your car. The loan is for a specific dollar amount with a fixed interest rate and paid in equal monthly installments over a series of months similar to a car loan.

Compare Best Offers Now. As mentioned the first step towards learning how to get a debt consolidation loan is ensuring your credit score meets the requirements for the. You may get a loan interest rate that.

Apply Online in 2 Minutes. Yes you can consolidate your car and personal loans if you qualify for a larger loan. Outsmart credit card companies.

Our Certified Debt Counselors Help You Achieve Financial Freedom. Paying off your auto loans could max out your. Keep an eye on the interest rates so you dont end up upside down.

While some credit cards offer low introductory rates most charge higher APRs than car loans. Using home equity or the strength of your credit to consolidate debt. Get a Free Consultation.

And if you have only credit card debt taking out a debt consolidation or personal loan can improve. Ad A Debt Consolidation Loan Alternative. Consolidating credit card debt can be a great way to save money through a lower-interest loan or credit card promotion.

Check your credit score. Our Certified Debt Counselors Help You Achieve Financial Freedom. Ad A Debt Consolidation Loan Alternative.

Best for Credit card consolidation loans. Be Debt Free Within 24-48 Months. Resolve From 15k to 300k Debt.

Apply For Freedom Debt Consolidation Today. Fixed rates from 699 APR to 2223 APR APR reflect the 025 autopay discount and a 025 direct deposit discount. Pros of Debt Consolidation.

Apply For Freedom Debt Consolidation Today. When your debt consolidation loan turns your credit cards back to a zero balance you may be tempted to use that credit which can further your credit card problem. Up to 25 cash back Consolidating your credit card debt allows you to reduce your interest rate lower your monthly payments but consolidating debt isnt always your best option.

The third lesson is that managing your credit card debt is also important The interest charges can be really expensive. Apply for a Consultation. Be Debt Free Within 24-48 Months.

Ad Tally can get you to 0 credit card debt faster. Be sure to check with your. In some cases credit card debt consolidation can help credit card users find better interest rates and simplify payments.

You have to repay the new loan just like any other loan. 100 Free to Get Rates. Consolidating your debt can have a number of advantages including faster more streamlined payoff and lower interest payments.

Similar to taking out a home equity loan dipping into your 401K savings is a high-risk option for credit card debt consolidation. You can use a balance transfer or even a debt consolidation loan without. A debt consolidation loan can lower your payment reduce your interest rate and simplify your debt management.

If you have good credit and a limited amount of debt you probably wont need to close your existing accounts. The good news is that with his current credit rating this consumer can. One Low Monthly Payment.

When you consolidate your credit card debt you are taking out a new loan. Its important to recognize that taking out a. Debt consolidation loan types include home equity loans.

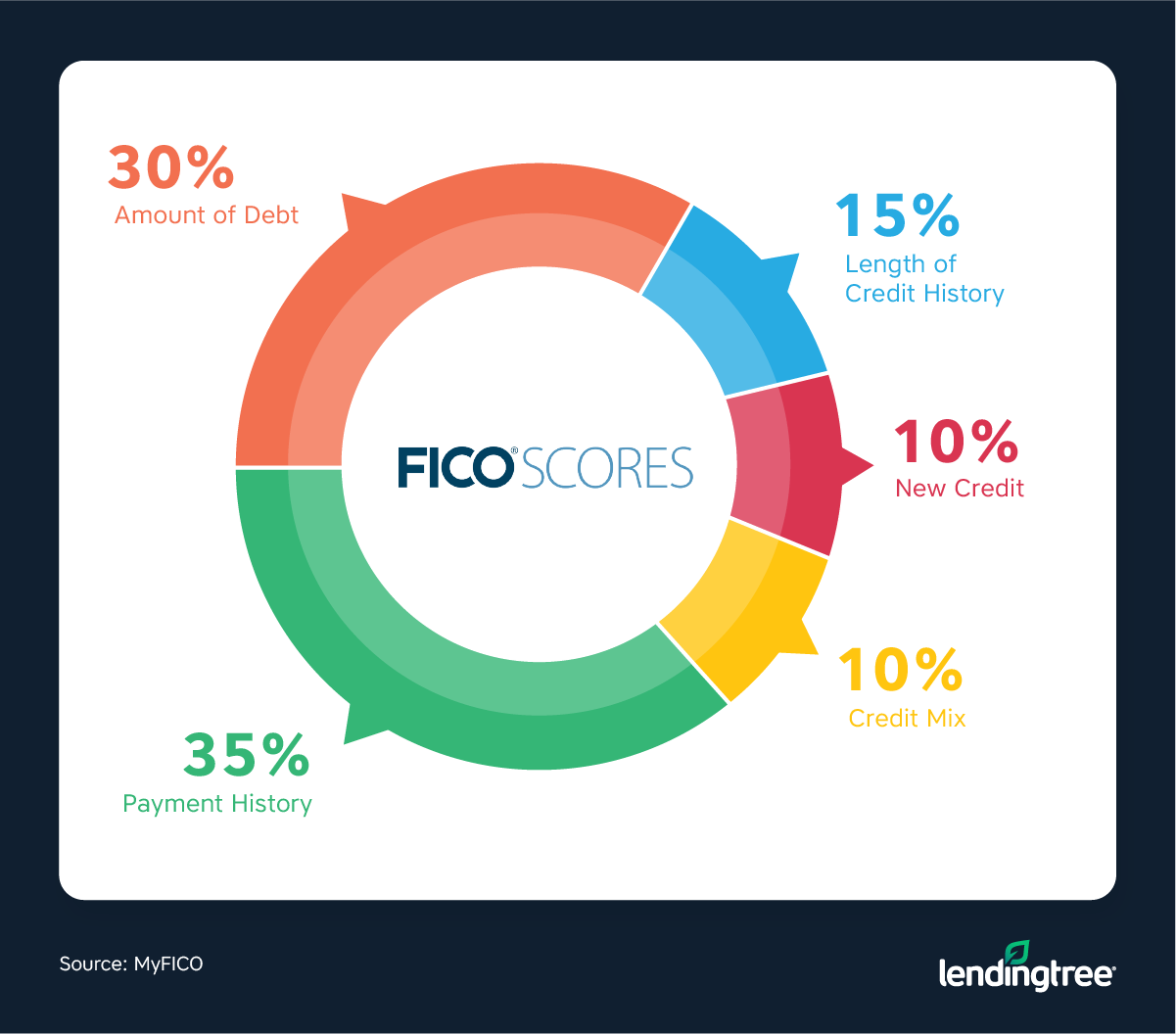

Payment history makes up 35 of your credit score according to Experian. A balance transfer is the process of moving a balance how much you owe from one credit card to another during credit card consolidation. Unbiased Expert Reviews Ratings.

Apply for a Consultation.

Personal Business Loans Cope Up With Your Debts With Personal Debt Consoli Debt Consolidation Loans Loan Consolidation Consolidate Credit Card Debt

Should You Pay Off Your Car Loan Or Credit Card Credello

Combining Auto Loans Consolidate Car Loans Lendingtree

Should You Consolidate Or Pay Bills With A Car Title Loan Hoyes Michalos

Tiptuesday Tag Someone That Needs This Information Mycreditreportiswrong Credit Creditrepair Consolidate Credit Card Debt Credit Repair Credit Monitoring

Check Your Rate Consolidate Credit Card Debt Paying Off Credit Cards Credit Card Consolidation

0 comments

Post a Comment